Michigan Estimated Tax Payments 2025 Online. We use cookies/browser's storage to personalize the content and improve user experience. To estimate your tax return for 2025/25, please select.

Quarterly tax payments are due april 15, june 15 and september 15 of the tax year, and january 15 of the next year. Welcome to michigan treasury online (mto)!

You must make estimated income tax payments if you expect to owe more then $500 when you file your 2025 mi.

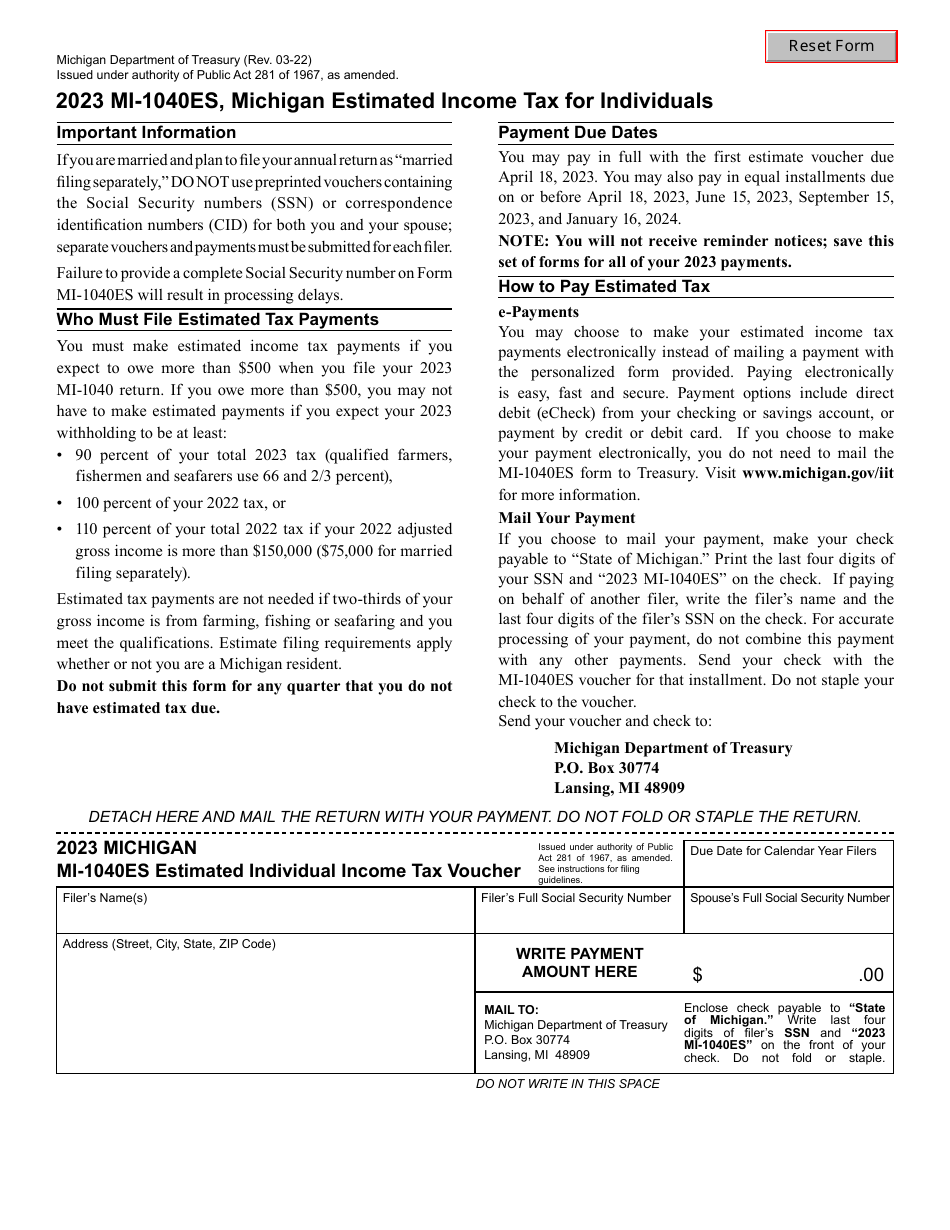

Form MI1040ES Download Fillable PDF or Fill Online Estimated, The michigan tax calculator includes tax. Updated for 2025 with income tax and social security deductables.

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, Based on the irs estimated income tax requirements, to avoid penalty and interest for underpaid estimates, your total tax paid through credits and withholding must be: Because treasury has started issuing the expanded michigan eitc supplemental check payments for tax year 2025, it is no longer.

Tax rates for the 2025 year of assessment Just One Lap, Treasury is committed to protecting. You must make estimated income tax payments if you expect to owe more then $500 when you file your 2025 mi.

Form 5080 Fill out & sign online DocHub, Updated for 2025 with income tax and social security deductables. Use our income tax calculator to find out what your take home pay will be in michigan for the tax year.

2025 estimated tax payment calculator IsmaCaroline, Who must file estimated tax payments. Based on the irs estimated income tax requirements, to avoid penalty and interest for underpaid estimates, your total tax paid through credits and withholding must be:

Oklahoma estimated tax Fill out & sign online DocHub, Based on the irs estimated income tax requirements, to avoid penalty and interest for underpaid estimates, your total tax paid through credits and withholding must be: Quarterly tax payments are due april 15, june 15 and september 15 of the tax year, and january 15 of the next year.

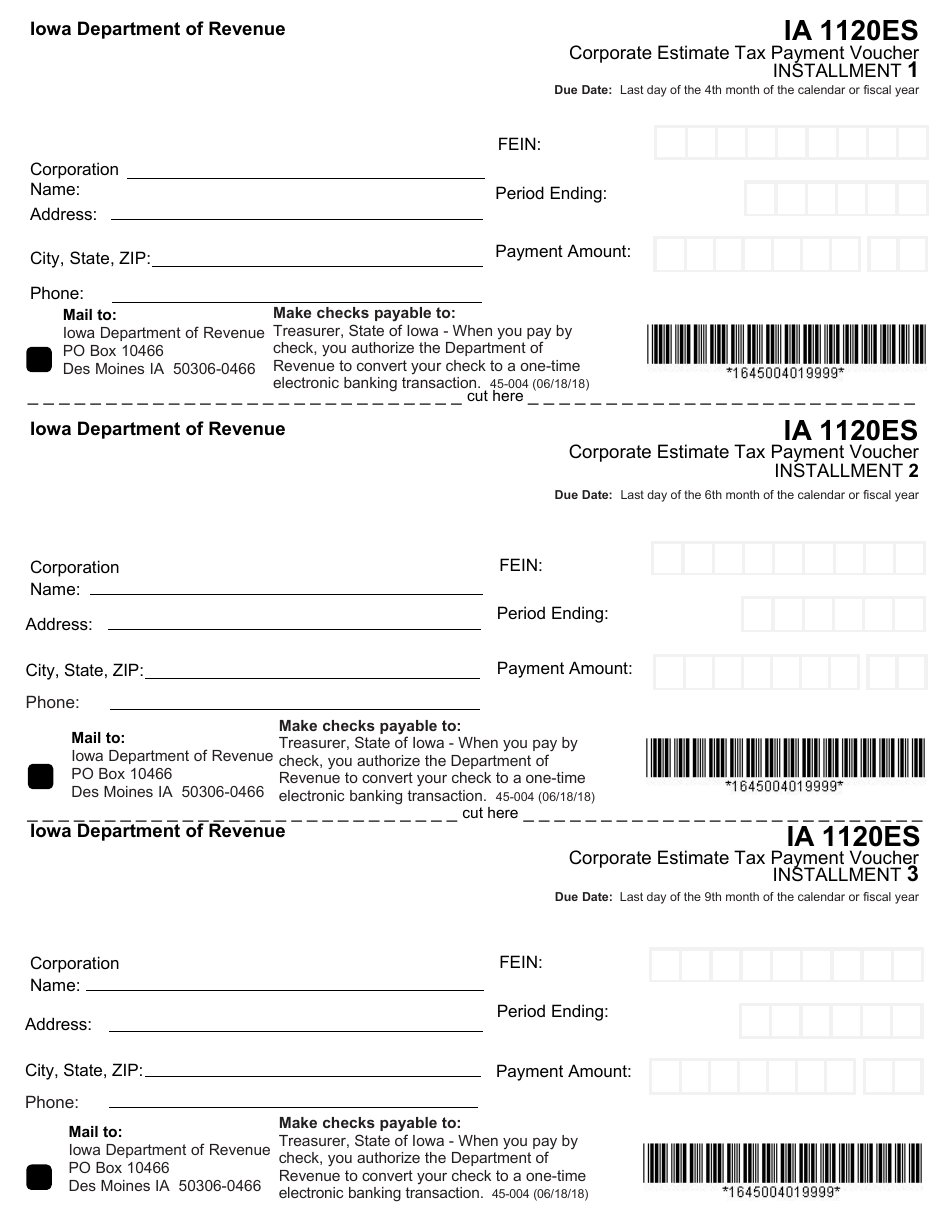

Form 45004 (IA1120ES) Fill Out, Sign Online and Download Fillable, Because treasury has started issuing the expanded michigan eitc supplemental check payments for tax year 2025, it is no longer. To estimate your tax return for 2025/25, please select.

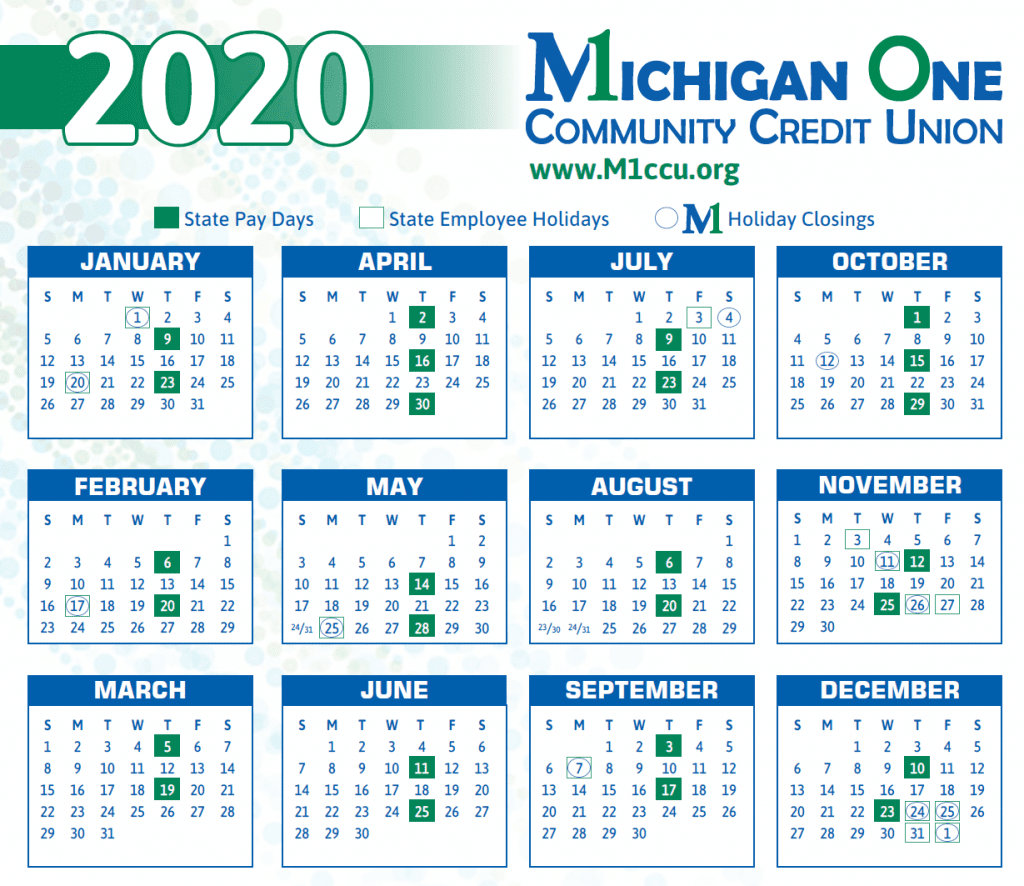

State of Michigan Payroll 2025 2025 Payroll Calendar, You must make estimated income tax payments if you expect to owe more then $500 when you file your 2025 mi. The free online 2025 income tax calculator for michigan.

Mi s1040 form Fill out & sign online DocHub, By accessing and using this computer system, you are consenting to system monitoring for law enforcement and other. Choose one of these options:

How to Pay Quarterly Estimated Taxes Online, Please enable javascript to continue using this application. Who must file estimated tax payments.

Use our income tax calculator to find out what your take home pay will be in michigan for the tax year.

The michigan state tax calculator (mis tax calculator) uses the latest federal tax tables and state tax tables for 2025/25.

Travel Hiking WordPress Theme By WP Elemento